Thinking Rate Cuts, Fast and Slow (+ a portfolio addition surprise)

You’ve probably heard of Daniel Kahneman – the recently deceased psychologist who won the Nobel Prize in Economics in 2002 for his groundbreaking work on behavioural economies.

Kahneman summed up much of his life’s work in his wonderful 2012 book, “Thinking, Fast and Slow”. (For those who haven’t, it’s a must read.)

Kahneman divided our brains and our thought processes into two characters:

System 1: Fast, automatic, intuitive and often subconscious, but prone to biases and errors.

System 2: Slow, deliberate, analytical, effortful and conscious. Our ‘slow’ brain is often used for complex decisions and calculations that require logical reasoning.

Things can, of course, go wrong in both brains. But it is System 1 that is most prone to cognitive biases like overconfidence, anchoring, framing effects and loss aversion.

Kahneman taught us that we are not the perfectly rational beings that economics once assumed. Yes, quick rules of thumb can help us get through life easier and quicker, but they can also get us into trouble.

What does this have to do with investing?

Well, plenty. If you fall prey to these biases in investing, you can lose serious money. (Way before Kahneman, even Warren Buffett’s teacher Ben Graham knew this when he said: “The investor’s chief problem, and even his worst enemy, is likely to be himself.”)

But the ‘fast’ versus ‘slow’ dichotomy has major relevance to investing today.

After being on hold since July last year, the US Federal Reserve is almost certainly going to start its rate-cutting cycle this month. You’d remember that global share markets sold off when talk of Fed rate hikes began back in 2021; and they sold off again then when the Fed actually raised rates in 2022. So does that mean that when the Fed starts to cut rates, it will be good for shares?

Well not so fast.

August 2024 Ophir Fund Performance

Before we jump into the Letter in more detail, we have included below a summary of the performance of the Ophir Funds during July. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +1.9% net of fees in August, outperforming its benchmark which returned -2.0%, and has delivered investors +22.3% p.a. post fees since inception (August 2012).

🡣 Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned +0.9% net of fees in August, outperforming its benchmark which returned +0.0%, and has delivered investors +13.1% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of +2.3% for the month.

🡣 Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned -0.4% net of fees in August, outperforming its benchmark which returned -2.1%, and has delivered investors +15.6% p.a. post fees since inception (October 2018).

🡣 Ophir Global Opportunities Fund Factsheet

Be careful what you wish for

Just as fast ‘System 1’ thinking can sometimes get you into trouble, fast rate cuts by the Fed can also be a worry.

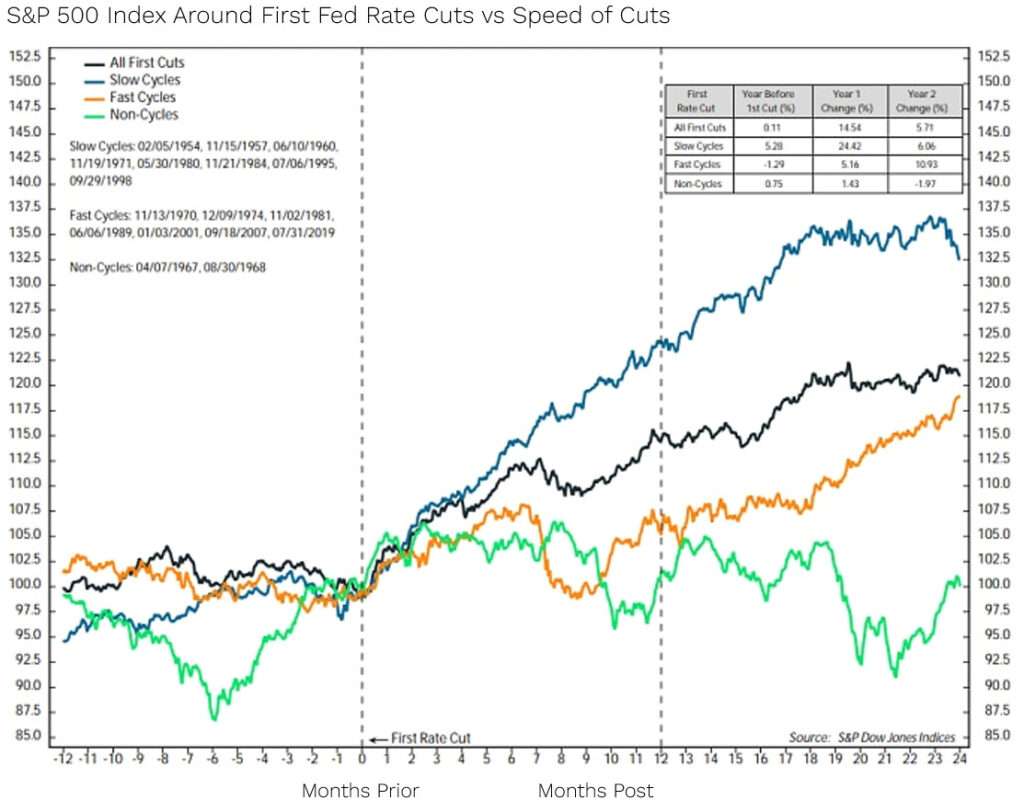

ND Research broke up the last 17 Fed rate-cutting cycles dating back to the 1950s into ‘fast’, ‘slow’ and ‘non-cycles’. (Fast cycles are those with at least five cuts in a year; slow is fewer than five cuts; and non-cycles are those with just one cut.)

As you can see in the chart below of the cycles, slow rate cut cycles (in blue) are the best for the share market (here the S&P500 index). Fast rate cut cycles (in orange) are the worst. (Non-cycles – in green – while technically the lowest performer, aren’t really rate cutting cycles at all with only one cut registered in 1967 and 1968 in a sideways moving market).

1954-8/30/2024. The chart and table shows S&P 500 Index performance around the start of Fed easing cycles. Y-axis is indexed to 100 at start of first rate cut. An index number is a figure reflecting price or quantity compared with a base value. The base value always has an index number of 100. The index number is then expressed as 100 times the ratio to the base value. A fast cycle (orange line) is one in which the Fed cuts rates at least five times a year. A slow cycle (blue line) has less than five cuts within a year while a non-cycle (green line) is case with just one cut. Black line represents all first cuts. Indexes are unmanaged, do not incur management fees, costs and expenses and cannot be invested in directly. Past performance is no guarantee of future results.

Why?

As we saw in the 2001 Dot.com bust-related recession, and the 2007-2009 Great Financial Crisis, when the Fed acts aggressively via ‘emergency’ rate cuts, it is usually responding to a recession or financial crisis characterised by falling corporate earnings. Investors become risk averse and slash the valuations they place on those now-reduced earnings.

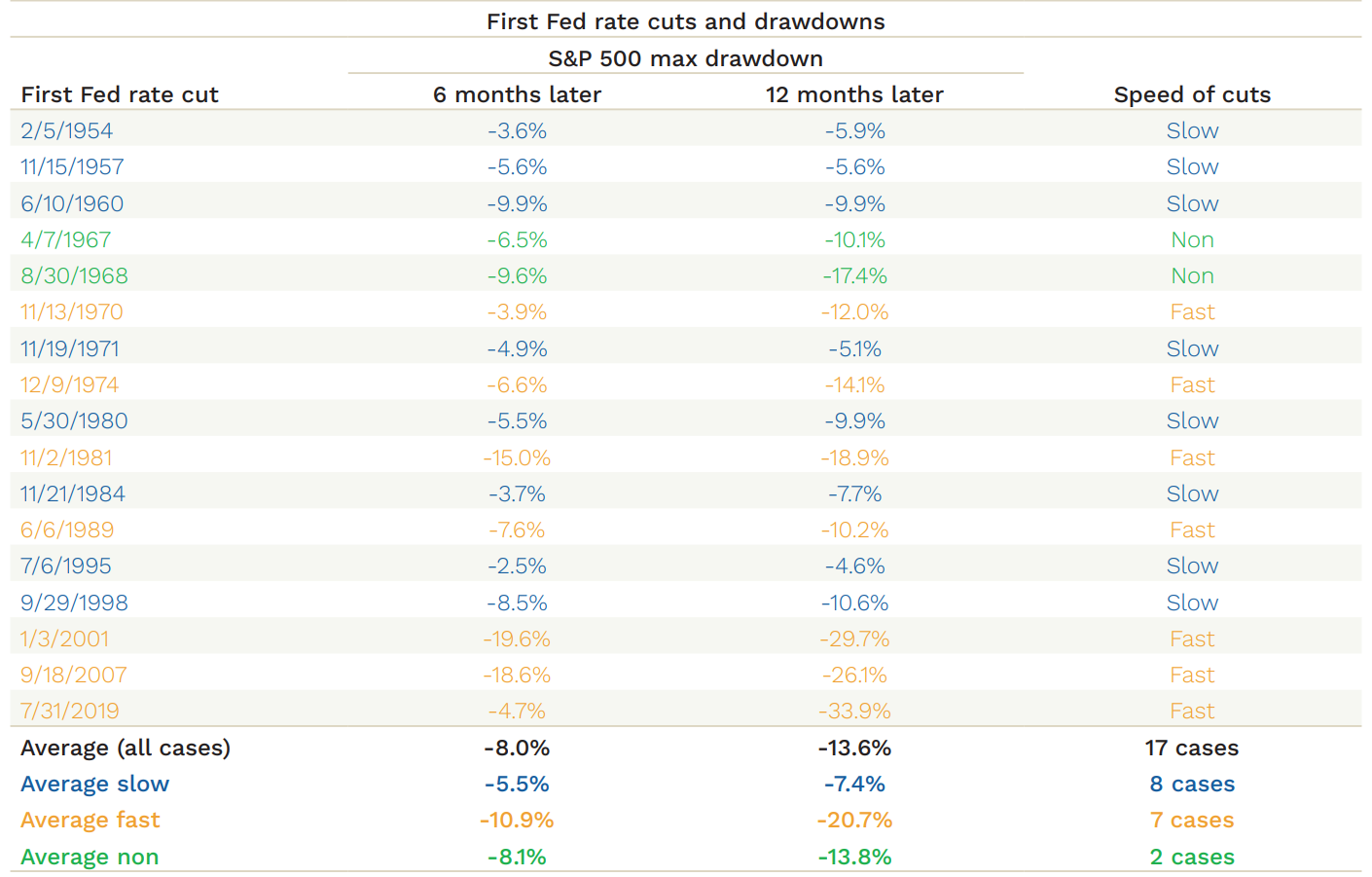

Our friends at Charles Schwab have taken this data a step further and looked at the maximum drawdown (that is peak to trough fall) in the 6 and 12 months after the Fed’s first cut.

Again, it’s clear that fast cycles tend to see bigger sell offs. (It also looks like fast cutting cycles have become more common in more recent decades.)

Source: Charles Schwab

So, what is the market expecting today?

Fixed income markets have priced in between nine and ten 0.25% rate cuts over the next year, with at least one 0.25% cut priced at each of the next six Federal Reserve meetings. If that eventuates, it will put this cycle in the ‘fast’ cutting camp.

At writing, however, equity markets don’t seem nearly as worried about a fast rate-cutting cycle as fixed-income markets – as witnessed by many major share market indices trading near all-time highs.

That might be because, while a sharp rate-cutting cycle is expected, it will only take the Federal Funds Rate back to a ‘normal’ level of around 2.75-3%. At those levels, rates won’t fall into the ‘stimulatory’ (below 2.5%) or ‘ultra-low’ levels near 0% that you might expect if a recession was forecast.

The positive news

The bottom line: share market investors should hope for a slow rate-cutting cycle because that means economic growth and corporate earnings are likely holding up well, providing support to share prices.

If fast rate cuts are on the cards, just like our errors in System 1 thinking, things are more likely to go awry in the near term in share markets.

There is positive news, however: on a 12-month horizon, both slow and fast cutting cycles have, on average, seen positive S&P500 returns.

For the rest of this month’s Letter to Investors, we wanted to give you some insight into a company that has been recently added to our Global Funds but that has been around literally for ages.

You’ve probably read one of their books!

Time to hit the books

It’s 1807. Thomas Jefferson was the US President. It’s the year Robert E Lee, the Confederate General during the American Civil War, was born. The Napoleonic Wars were raging. And it’s the year Charles Wiley opened a tiny print shop in Manhattan.

When Charles died in 1826, his son John took over the business. Like any good son, he put his name on the business as if he were the founder(!). It became John Wiley. Eventually, when his kids joined the business, the company adopted its current name: John Wiley and Sons – though today many just call it Wiley (NYSE: WLY).

Wiley is now one of the world’s largest publishers, with products ranging from academic journals and articles, to textbooks and professional assessments.

If you went to university, chances are you read a book with ‘Wiley’ on the cover.

At its heart, Wiley enables the creation of new knowledge at the frontier of thinking in such diverse areas as science, medicine, technology, engineering, business, economics and finance.

The business is broken up into two key segments:

1. Research

Wiley has one of the world’s leading portfolios of journals and operates the Wiley Online Library. It is the home to some of the most prestigious academic journals in the world, including the Journal of Finance.

Source: AppAdvice – The Journal of Finance

2. Learning

Learning includes academic publishing and courseware for higher education students, as well as books and assessments for professionals. The content is increasingly valued for GenAI models, a topic we’ll touch on later. Learning also includes books such as the well-known ‘For Dummies’ series – books that probably provide investment advice a little more accessible to the average punter than the wonky Journal of Finance!

Source: for Dummies – A Wiley Brand

Wiley’s competitive advantage lies in a number of things:

- its massive content library which includes circa 2,000 journals and over 40 million published articles;

- its relationships with some of the brightest minds in the world as authors;

- its incumbent category leadership; and

- its brand and reputation that has spanned centuries.

Ok, but why does Ophir own it, you ask?

Doesn’t Ophir only invest in new up-and-coming, fast-growing companies?

4 reasons why we own Wiley

We invest in companies that we believe are growing faster than the market thinks; and we don’t overpay for that growth. Sometimes that is a new business; and sometimes, as in the case of Wiley, that can be an old business that for whatever reason is experiencing new, accelerating growth.

Essentially, there are four key reasons why we like Wiley today:

1. It’s easier to find bargains where no one is looking

Despite Wiley being around $A3.5 billion in market cap and generating over $A2.5 billion in revenue, only one broker analyst covers the stock: the previously-unknown-to-us CJS Securities. If Wiley was listed in Australia, its market cap would put it in the ASX mid-cap universe, for which the median number of broker analysts for a company is 13!

Talk about under researched.

It’s easier to find $100 bills still lying around on the street when you are the only one walking down it.

Our investment process is all about getting an edge on a company over the market. The fewer the analysts ‘doing the work’, the more likely we’ll be able to get an edge and find a company outperforming the market’s consensus. Just one broker, CJS Securities, is in effect the ‘market consensus’ for Wiley.

2. Earnings acceleration through digitisation

We expect the business to grow earnings 15-20% pa over the next few years. Revenue has been accelerating after research submissions for journals rebounded post COVID and because Wiley has been digitising its back catalogue of journals/articles over the last few years. Revenue from its digitised back catalogue is dropping through to its bottom line at higher incremental gross profit margins (over 80%). A cost-cutting program, including divesting three non-core business, now just complete, is also helping its bottom line.

3. Competitor IPO shows Wiley’s valuation is attractive

Over in Europe, their big German competitor, Springer Nature, has just announced its imminent IPO and listing on the Frankfurth Stock Exchange. We have met the company multiple times and one of our team very recently travelled to the UK to meet them as part of the pre-IPO “testing the waters” and to gain more intel as a part of our Wiley holding. We think it’s likely Springer’s team of Tier 1 bulge bracket Investment Banks (JP Morgan, Morgan Stanley and Deutsche Bank) will seek a valuation multiple of around 20x 2025 earnings. Wiley, which is growing at a similar rate, is trading on a much cheaper 13x 2025 earnings. We think its likely that the Springer Nature listing will bring significant interest to the space, and Wiley, given its similar growth and business model, but much cheaper valuation.

4. Free optionality: GenAI

You might not think a company that has been around for over 200 years would be at the forefront of artificial intelligence (AI). But Wiley just closed its second licencing agreement with a business customer so they can utilise its content to train their Generative AI (GenAI) models. Most this initial interest is relates to book content in the Learning Division. We can also see this broadening out in the future to the Research division’s academic journal and article content.

So far, Wiley’s GenAI agreements have been for back catalogue content three years or older. But, again, this could become a more recurring revenue source if Wiley provides access to its latest content on an ongoing basis. With around 40 million published articles, Wiley is sitting pretty as a prime source of information to train these models now, and into the future.

For investors in Wiley, this is a completely unpriced and free option. We have seen Shutterstock and Getty Images, whom we have spoken to, recently cash in on the opportunity to use their catalogue of images for training GenAI models. Reddit, the social media forum, also recently signed a deal with Google to use content for its AI training models. Its March IPO has been a success.

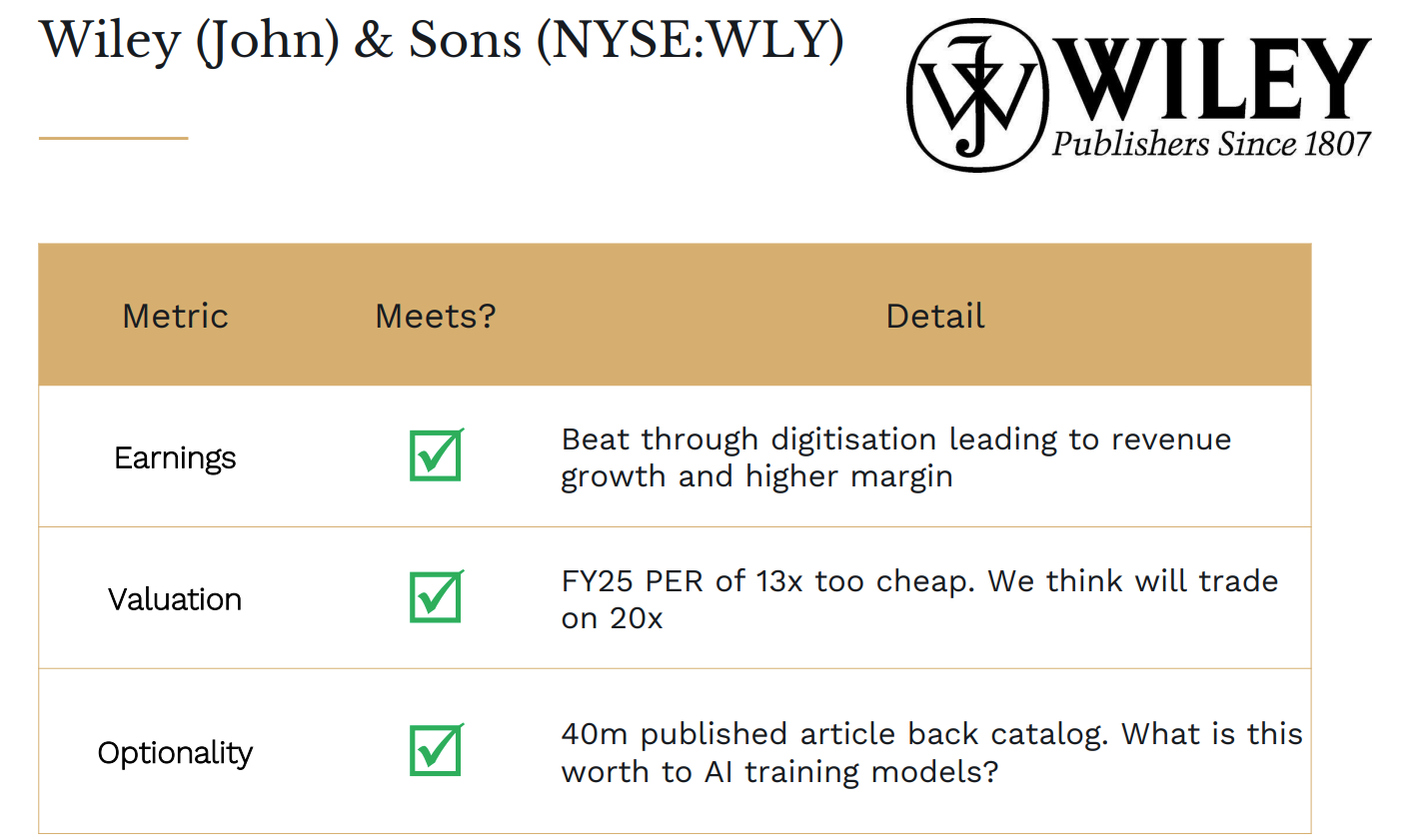

All up, Wiley ticks the three key investment selection criteria for us:

- Earnings beating expectations.

- Margin of safety through a cheap valuation.

- Free or cheap growth optionality in the future.

Source: Ophir

So, though Wiley’s been around a while, this is definitely a case of an old company that has some new tricks.

While the small cap market overall waits for its catalyst to start outperforming large caps again, we remain focussed on finding businesses like Wiley that have their own unique catalysts to drive growth and fund performance today. No matter the broader interest rate or macroeconomic backdrop.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.