Welcome to the May Ophir Letter to Investors – thank you for investing alongside us for the long term.

Earnings matter longer term. Are they starting to again?

We often get asked, “who are your investment heroes?”

Many might think the obvious answer is Warren Buffett.

But that award actually goes to Peter Lynch.

Lynch managed Fidelity’s Magellan Fund from 1977 to 1990, generating remarkable returns. Magellan averaged a 29.2% annual return, nearly twice the S&P500’s 15.8%.

Lynch’s strategy is closely aligned with ‘GARP’ (Growth At a Reasonable Price). The strategy looks for companies growing faster than average (growth), but with a strong focus on not overpaying for that growth (reasonable price).

GARP, of course, is the general approach we use here at Ophir.

Lynch popularised “investing in what you know”: focusing on insights from everyday life, such as the products you buy at the supermarket, to get a market edge. On weekends, the Ophir investment team’s text chat group pings with investment ideas to investigate inspired by things we’ve seen in everyday life.

Lynch also coined the term ‘ten bagger’, the rare feat where an investment rises ten times its original purchase price. We’ve been lucky to bag a few ten-baggers and a handful of stocks in our portfolios definitely have ten-bagger potential.

Lynch’s two most famous books are ‘Beating the Street’ and ‘One Up on Wall Street’, both must-reads for any share market newcomer.

But perhaps our favourite Peter Lynch investing dictum of all time is:

“Often, there is no correlation between the success of a company’s operations and the success of its stock over a few months or a few years. In the long term, there is 100 percent correlation between the success of the company and the success of its stock.”

(For proof of this, check out the ‘Key drivers of stock performance’ chart from our last Letter to Investors (https://www.ophiram.com.au/letter-to-investors-april-5/).)

As you probably know, our portfolios have weathered one of those short-term periods where share prices become disconnected from earnings.

In late 2021 through mid-2022, small-cap growth companies, in which we invest, got hammered as interest rates increased. Yet at the same time, their underlying earnings continued to grow.

But is that beginning to change?

During the recent reporting season, in our Global Funds at least, earnings momentum and ‘beats’ finally looked like they are being rewarded by the market again to a degree we haven’t seen for some years. This is good news for investors as earnings growth and positive share price reactions to it are the most sustainable form of performance generation in our funds.

We’ll explore this theme further in this month’s Letter to Investors, using a core stock holding, Zeta, as an example of a stock where the share price is finally catching up with stellar earnings beats.

And we’ll also look at what the current bearishness of Wall Street strategists can and can’t tell us about what lies ahead for markets.

May 2024 Ophir Fund Performance

Before we jump into the letter in more detail, we have included below a summary of the performance of the Ophir Funds during May. Please click on the factsheets if you would like a more detailed summary of the performance of the relevant fund.

The Ophir Opportunities Fund returned +3.1% net of fees in May, outperforming its benchmark which was flat, and has delivered investors +21.8% p.a. post fees since inception (August 2012).

🡣 Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned +2.5% net of fees in May, outperforming its benchmark which returned +0.2%, and has delivered investors +13.1% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of +1.2% for the month.

🡣 Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities returned +5.8% net of fees in May, outperforming its benchmark which returned +1.2%, and has delivered investors +15.0% p.a. post fees since inception (October 2018).

🡣 Ophir Global Opportunities Fund Factsheet

There’s a bear in there.

Share markets continue to put on gains during May, with the big gorilla of share markets, the United States, leading the way once again. The NASDAQ, S&P 500, and Russell 2000, were up 7.0%, 5.0% and 5.0% respectively. The S&P 500 at writing closed at 5,361 (10th June), a new all-time high.

The S&P 500 is up 12.4% this year and 49.9% from the start of this bull market in October 2022. If you were a momentum investor, surely you’d think this rally had more legs right after such strong gains?

Not so says Wall Street.

Below, we show the S&P 500 end of 2024 price target for 27 of Wall Street’s finest Investment Strategist from all the major brokers.

| Broker | Strategist | S&P 500 year end target | Change from current level (5,361) |

| UBS | Jonathan Golub | 5,600 | 4.5% |

| BMO | Brian Belski | 5,600 | 4.5% |

| DZ Bank | Sven Streibel | 5,600 | 4.5% |

| Wells Fargo | Chris Harvey | 5,535 | 3.2% |

| Deutsche | Bankim Chadha | 5,500 | 2.6% |

| Natixis | Emilie Tetard | 5,500 | 2.6% |

| Societe Generale | Manish Kabra | 5,500 | 2.6% |

| Oppenheimer | John Stoltzfus | 5,500 | 2.6% |

| HSBC | Nicole Inui | 5,400 | 0.7% |

| BofA Securities | Savita Subramanian | 5,400 | 0.7% |

| Yardeni Research | Dr Ed Yardeni | 5,400 | 0.7% |

| RBC | Lori Calvasina | 5,300 | -1.1% |

| Barclays | Venu Krishna | 5,300 | -1.1% |

| Ned Davis Research | Ed Clissold | 5,250 | -2.1% |

| 22V Research | Dennis Debusschere | 5,250 | -2.1% |

| Piper Sandler | Michael Kantrowitz | 5,250 | -2.1% |

| Goldman Sachs | David Kostin | 5,200 | -3.0% |

| Ameriprise | Anthony Saglimbene | 5,200 | -3.0% |

| Fundstrat | Thomas Lee | 5,200 | -3.0% |

| BNP Paribas Exane | Greg Boutle | 5,150 | -3.9% |

| Citi | Scott Chronert | 5,100 | -4.9% |

| Stifel | Barry Bannister | 4,750 | -11.4% |

| Evercore ISI | Julian Emanuel | 4,750 | -11.4% |

| Scotiabank | Hugo Ste-Marie | 4,600 | -14.2% |

| Cantor | Eric Johnston | 4,400 | -17.9% |

| JP Morgan | Dubravko Lakos-Bujas | 4,200 | -21.7% |

| BCA Research | Peter Berezin | 3,500 | -34.7% |

Source: Bloomberg. As at 11th June 2024

Their average and median forecasts for the end of this year are 5,146 and 5,250 each. That’s -4% and -2% respectively below the current S&P 500 level.

In fact, 60% of them have the S&P 500 going backwards over the rest of 2024.

Pretty bearish stuff right!

The most bullish forecaster, UBS, has an implied return of 4.5%. That’s bang in line with what you could get per annum by parking your cash in safe-as-houses 10-year US Treasury Bonds.

So, should investors be selling up and parking their money in cash?

Not so fast.

The track record of any one strategist, or even the collective, is not that stellar.

Returning to Peter Lynch, he says:

“Nobody can predict interest rates, the future direction of the economy or the stock market. Dismiss all such forecasts and concentrate on what’s actually happening to the companies in which you are invested.”

The same strategists were all too bearish at the start of 2024. Every one of them had their end-of-2024 forecast eclipsed by the end of May, just five months into this year.

Not betting big on a recession call

While we wouldn’t be putting all our chips on one star strategist, or tilting our portfolios majorly on the current relatively bearish collective view, we think there are a couple of insights to be gained from the strategists’ outlook:

- In their commentary, most strategists see limited upside because valuations on the S&P 500 are already very high at 25x P/E (12-month historical earnings). Corporate earnings growth should also be limited because economic (real GDP) growth is forecast to be subdued at sub 2% for the rest of 2024. This suggests that any attractive share market returns will be found in cheaper pockets. Fortunately, small caps with better growth prospects (at Ophir, finding these is our raison d’etre) is one of these areas.

- While economic soft landing in the US has become more likely over the last year, recession still remains a possibility. This is THE key reason groups like JP Morgan and BCA Research have material downside for the S&P 500 in their forecasts. This cannot be ignored, and is one of the reasons – along with ‘at the coal face’ company outlooks and other leading economic data – that we have not loaded up on cyclically exposed growth companies, despite a reasonable probability of growth-supporting US rate cuts this year.

Similarly, though, we are not positioned in an overly bearish fashion either. Like the proverbial boy who cried wolf, long-time recession callers (such as JP Morgan and BCA Research) have consistently been proven wrong over the last 1-2 years. Even if they are ultimately proven right, and a US recession does occur in the next year, being early is the equivalent of being wrong in markets.

Staying on our Peter Lynch theme he notes:

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections than has been lost in corrections themselves.”

Bottom line: don’t bet too big on any recession call.

No economic forecaster’s crystal ball is that crystal clear.

Reporting season – earnings finally coming to the fore?

May was a great month for performance across the Ophir Funds, with all outperforming materially. But it was the Global Funds that were the standout.

The best part was that it was earnings ‘beats’ and momentum that drove the outperformance. This is the best driver because it’s what our investment process targets.

It is, by far, the most sustainable driver of outperformance over the long term.

If outperformance was driven instead by style tailwinds – for growth stocks or small caps – then this is unlikely to persist indefinitely and may just as easily reverse in the future.

In May, most companies in our Global Funds reported Q1 earnings results with a high level of earnings ‘beats’ (earnings coming in more than 2% above market consensus expectations) and ‘raised’ guidance (earnings guidance raised by the company for the next quarter/full year).

The biggest takeaway, though, was not that the number of ‘beats’ and ‘raises’ was good, but rather the market reaction.

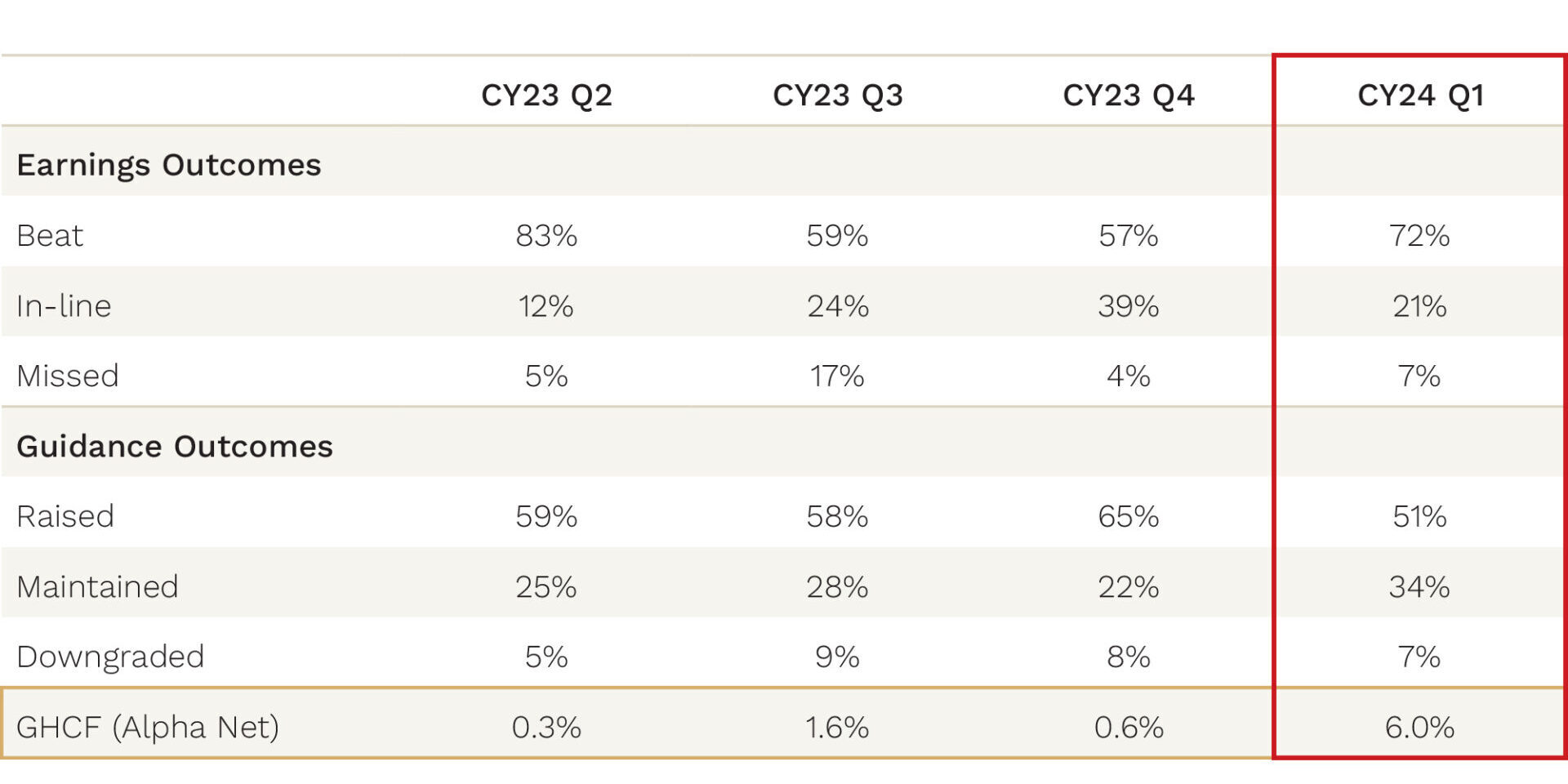

You can see in the bottom row of the table below the outperformance of the Ophir Global High Conviction Fund compared to its benchmark for the key reporting month each quarter.

Global Funds – Reporting Season Outcomes

Source: Ophir. The results are weighted by the portfolio weights of the constituents that reported. GHCF Alpha = Net Outperformance during the main month of each reporting season (August, November, February, May)

While we were getting similar levels of ‘beats’ and ‘raises’ in the last few quarters, we weren’t getting significantly rewarded with share-price gains.

That changed this quarter, with these companies generally up around 10-30% on the month in May after their good earnings results.

This is a stark change from late 2021 and 2022 where, despite similar levels of good earnings results, Fund performance during reporting seasons – compared to our benchmark – was negative as high inflation/rates saw steep falls in valuations offset the positive earnings benefit.

Zeta beats rewarded

It is too early to be confident the greater role of earnings in performance for our Global Funds will continue in the short term. But we remain highly confident that, regardless, it will continue to stand our long-term performance, as it has historically, in good stead.

To bring to life this recent marked change in market sentiment towards some of our holdings in the Global Funds, we thought we’d share with you the example of Zeta Global Holdings (ZETA US).

Zeta is an AUD$5.4 billion market cap New York Stock Exchange-listed marketing technology company. It was founded in 2007 and listed in 2021.

Its data and AI-powered cloud platform provides enterprise users with customer intelligence and marketing automation software solutions.

Zeta has the largest omnichannel market platform with identity data of customers at its core, over 40% of the Fortune 100 as customers, and competes with the marketing cloud offerings of Oracle, Adobe and Salesforce.

The company has grown revenue by +20% for the last 9 quarters and has more than doubled revenues from US$368 million to US$729 million over the last three years.

Since listing, Zeta has consistently beaten market expectations on fundamentals, with circa 5-10% revenue beats each quarter.

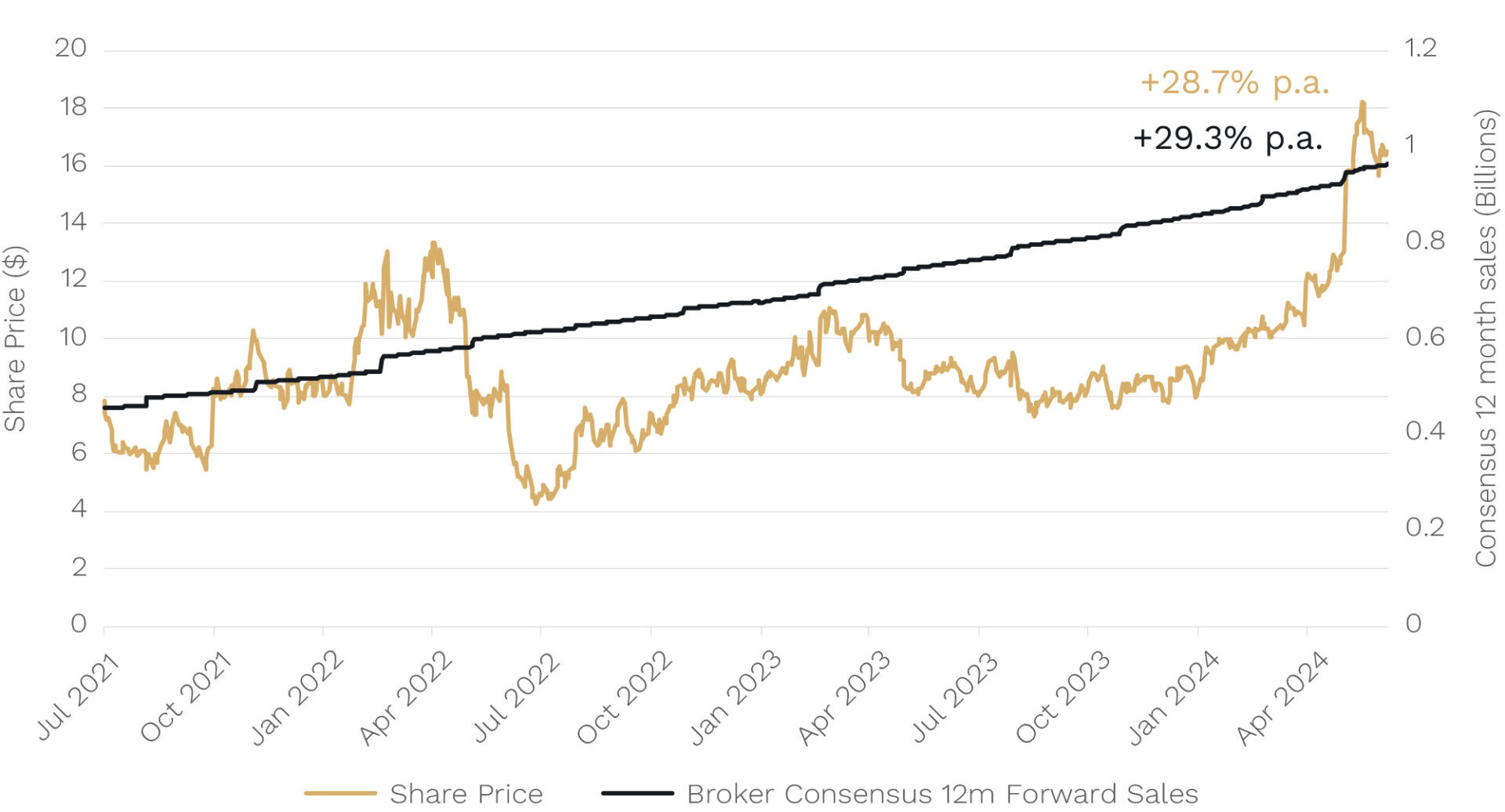

We show this below in the black line where broker consensus expectations for revenue for the next 12 months has consistently been revised up each quarter that the company has reported its financial results.

Zeta’s Share Price Growth Catching Up to its Sales Growth

Source: Bloomberg. Zeta Share Price & Estimates Sales Figures 6 July 2021 – 31 May 2024.

Despite this consistent growth in the key driver of the business, the share price has been far more volatile and lagged the growth in revenues. That is until very recently.

Zeta has delivered ‘beats’ over the last few quarters, including the most recent quarterly result on May 6th, but it was only more recently that the market has rewarded this consistent growth.

In Lynch’s words, there has been “no correlation between the success of a company’s operation and the success of its stock” for Zeta over 2022 and 2023.

But “in the long term there is 100% correlation”, with forward revenues and the share price both growing almost identically about 29% over the last three years.

Following our north star

This remains the perpetual challenge for investors.

You are not right or wrong in the short, or even the medium term, because Mr Market tells you through a share price that doesn’t reflect fundamentals.

Rather, when prices move away from fundamentals, it creates opportunities for investors to increase or lighten positions as the circumstances dictate.

You may never know the exact catalyst, but, ultimately, share prices follow a north star … and that north star – Ophir’s north star – is company fundamentals.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.