Gold has been grabbing headlines. You would most probably have seen the precious metal has surged to all-time highs. And gold bars have cracked US$1 million for the first time ever this year.*

*Gold bars typically weigh 400 troy ounces and the gold price surpassed US$2,500 for the first time ever in August this year.

In Australia, gold miners now make up 7.6% of the ASX Small Ords Index – making it a key player in the local investment landscape.

But should investors be joining this gold rush and increasing their exposure?

In this month’s Strategy Note, we explore gold’s history and what is driving the gold price today. And, importantly, we look at how at Ophir we are gaining exposure to surging gold prices while remaining true to our core investment philosophy.

Gold versus Equities

From 1971 to the early 2000s, the gold price had been relatively stable. Gold was, for the longest time, considered a hedge against inflation, economic shocks and currency devaluation.

Then gold soared in 2003 in the lead up to the Iraq war as investors used the commodity as a safe-haven asset. (By coincidence, the first gold ETF was launched in 2003 on the ASX).

All up, since the decoupling of the gold standard in 1971, the gold price has increased from US$43 to US$2,642 per troy ounce at time of writing.

On the face of it, this appears to be a good investment. But the return from gold has been meagre when compared to equities. From 1971 to now, while gold has returned 5,977%, the S&P 500 has delivered a return of 24,472%.

Gold’s Relationship with Real Yields

So why has gold gone up at all?

There is no simple answer.

There is an element of basic supply and demand at work. Gold is a physical asset with a finite supply, so less supply over time should cause an uplift in its price. Similarly, any boost in demand should also see its price rise.

(ETFs have provided easier access to the commodity, so this would also have helped increase demand.)

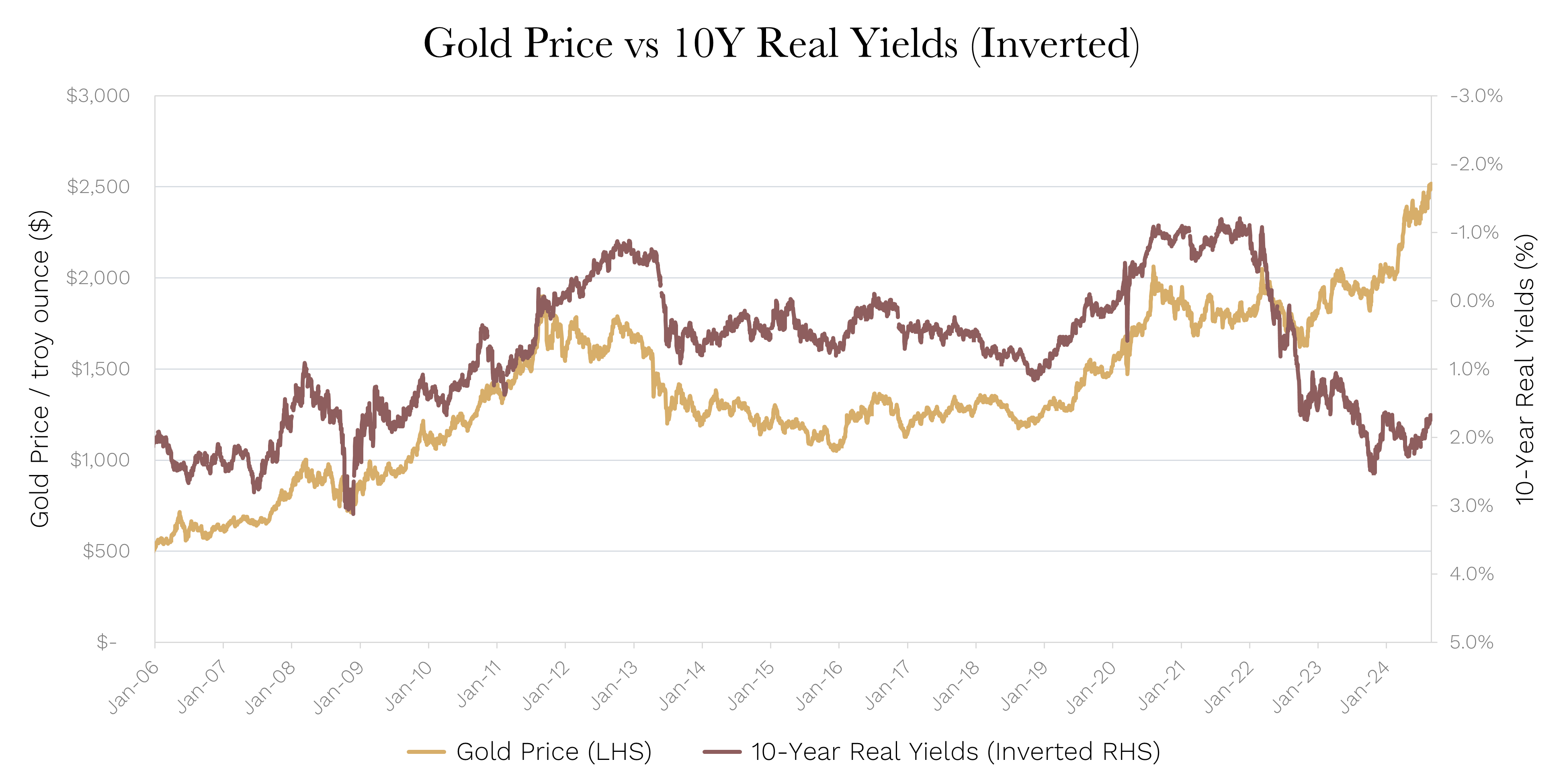

Another driver has been real yields – the nominal bond yield minus inflation.

Historically, at least most of the last two decades, gold has been inversely correlated to real yields.

When real yields are trending higher, and fixed income investments provide adequate income to beat inflation, the gold price has decreased because it becomes relatively less attractive as a non-yielding asset. When real yields are falling, the gold price tends to increase because those real yields become less attractive.

Source: Ophir. Bloomberg.

This inverse correlation is not perfect but has remained consistent over time.

Why the relationship fell apart

But wait – why has gold pushed higher in recent times when real yields are increasing?

If correlations had held, shouldn’t the gold price have been trending lower over the last two years?

Has the relationship changed?

From 2022 through 2023, it appears three things have all taken turns in pushing the gold price higher, despite the surge in real yields:

- Firstly, the Russia-Ukraine war in early 2022 seemed to increase gold’s attraction as a safe haven.

- Then the rise in inflation expectations throughout 2022 seemed to see more investors buy gold as an inflation hedge.

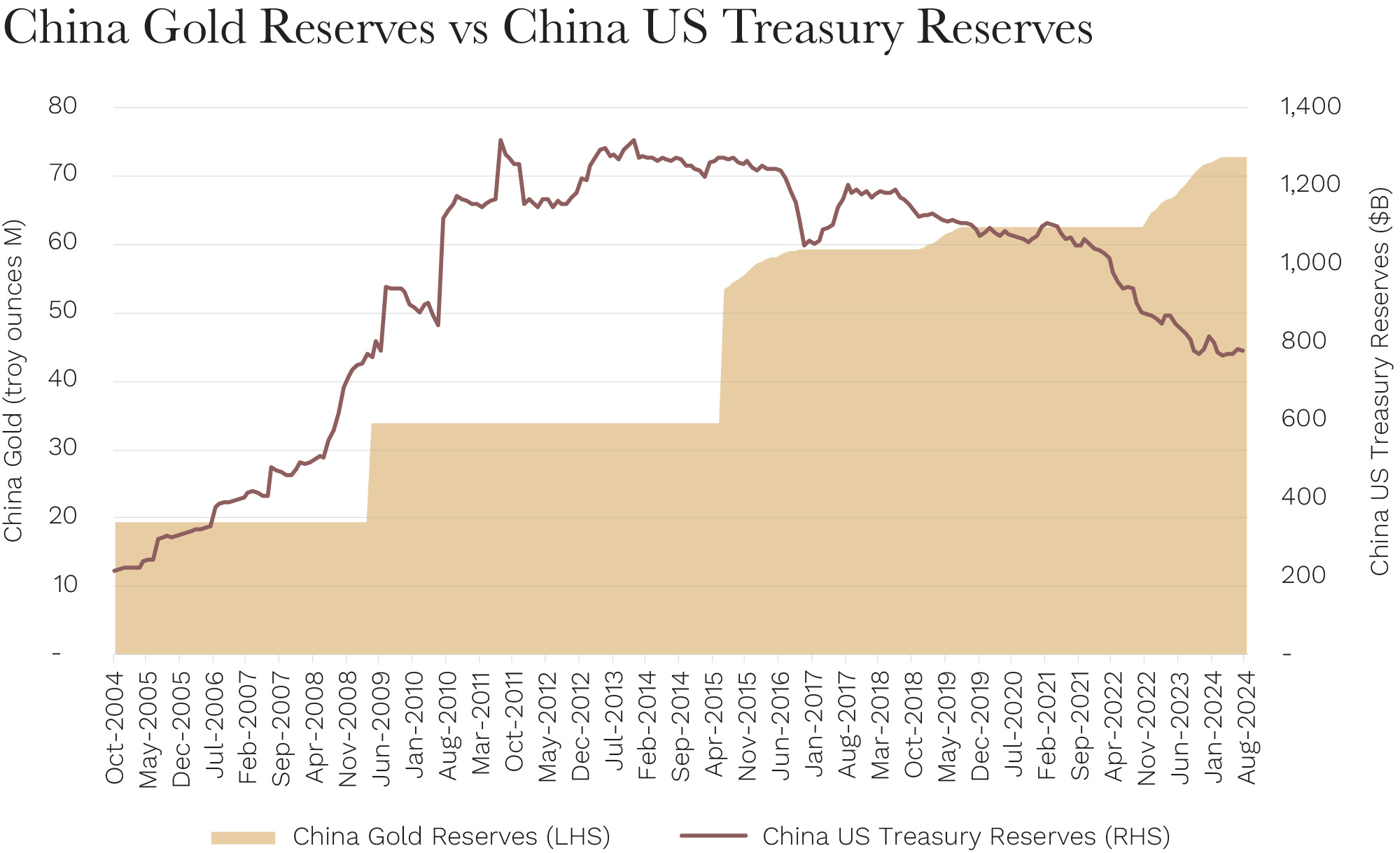

- And, finally, as the US dollar depreciated through late 2022 and 2023 it increased the attractiveness of gold, which is priced in US dollars, to foreign buyers. One such buyer has been central banks which, according to the World Gold Council, purchased more than 1,000 tonnes of gold in 2022, more than two times the annual average of the previous five years. For example, China has been reducing their US Treasury bond holdings while increasing their gold reserves. India is also increasing their gold reserves at an increasing rate.

Source: Ophir. Bloomberg.

A return to normal

Since late 2023, when the US Federal Reserve signalled they were done hiking interest rates and that rate cuts were on the cards for 2024, real yields have started falling again.

History suggests that during rate-cutting cycles the negative relationship between real yields and the gold price tends to strengthen.

And that is what we have seen since late 2023: real yields have fallen and the gold price has continued to surge to new all-time highs.

Where it goes from here is anyone’s guess. But if you expect real yields to continuing falling back to their longer term average of around 1.5%, then there still may be a little upside to the gold price left near term.

Backing the manager: How Ophir invests in gold

To paraphrase Warren Buffett – “[gold] won’t do anything … except look at you”.

We have a similar sentiment at Ophir: That gold itself is not a worthwhile investment because it is a non-yielding asset and has no cashflows.

However, over the years Ophir has invested in the gold space and done reasonably well.

But we do not invest in gold itself. Instead, we invest in good miners who run gold mines efficiently and economically with strong cashflows following.

As with other non-mining companies, we look for gold producers that will beat on earnings and raise guidance for their next results.

We have built up expertise in Australia of identifying the best mining – and in this case gold mining – managers and management teams.

For us, it’s more of a case of backing the jockey (management), rather than the horse (the specific commodity). We expect these jockeys to have their expertise result in higher cash flows over times, despite the natural cyclicality of the underlying commodities they are leveraged to.

Backing the jockey works particularly well for the gold sector as their capital bases are smaller compared to other commodities so that you can buy an old mine and turn it around pretty quickly. Contrast this to an iron ore mine that needs billions in capex to make a difference.

The sales and marketing effort for gold is also MUCH easier. One of our old investing mentors used to say all you need to do is charter a plane, put the gold bars in it and fly to a major city and that was the extent of your sales effort! Compare that with the comparative logistical complexity of rail, ports, shipping and the like to get iron ore to its destination.

Historically, in the gold sector, we have invested in Bill Beament when he ran Northern Star (now at Develop Global). And we currently invest in a number of high-quality gold miners, including Luke Creagh at Ora Banda.

So despite typically being underweight the Materials sector in our Australian funds, where it is a big part of the index, we haven’t shied away from the sector and have made some great money for our investors by sticking with a few first-rate managers.

But we leave it to the likes of Ora Banda and its gold experts to make short-term decisions based on the commodity price. And we invest in the strategic nous of management and the operational effectiveness of the business over the longer term – just as we would in any other sector.