Have you been wondering why there are so many more delayed flights since COVID? It’s because manufacturers are struggling to clear production backlogs, so planes are getting older.

We started thinking about who could benefit from this dynamic and it led us to our recent investment: Chicago based Aerospace and Defence company, AAR Corp (NYSE: AIR).

The aviation supply chain crisis

We have closely followed the global aviation supply chain for several years, and we have owned various companies from the sector during this period. However, we recently started digging deeper into the space following the persistent disruptions to both aircraft and engine production.

Manufacturers, most notably Boeing & Airbus, have struggled with supply chain bottlenecks, labour shortages and material constraints, all of which has led to delays in new aircraft deliveries and spare parts.

Airlines and operators have been forced to extend the life of their existing fleets. That has increased demand for maintenance, repair, and overhaul (MRO) services, as well as driven a surge in the used and surplus parts market.

Source: Company Reports, KeyBanc Capital Markets Inc.

All of this comes as the global commercial fleet already has an average aircraft age of ~15 years vs retirement age of ~23 years. At the same time, we will likely see sustained growth in global passenger miles for the foreseeable future.

Source: IATA, Airline Monitor, KeyBanc Capital Markets Inc.

On the hunt for who could benefit

Given this backdrop, we asked: which small-cap companies could benefit from this dynamic over the medium-long term? We met with a multitude of players in the ecosystem, including:

- Parts distributors/MRO (maintenance, repair and overhaul) operators like VSE Corp (NASDAQ: VSEC);

- Original Equipment Manufacturer (OEM) suppliers like Woodward (NASDAQ: WWD), recently listed Loar (NYSE: LOAR) and Montana Aerospace (SWX: AERO); and

- Aircraft/engine lessors like Willis Lease Finance Corp (NASDAQ: WLFC).

We even flew to Montreal to meet CAE (TSE: CAE), the global leader in simulation-based training for aviation.

But we found one stock that stood out – AAR Corp (NYSE:AIR).

AAR gave us by far the cheapest and least-discovered exposure in the sector.

That naturally warranted a deeper dive. So, we contacted the company for a meeting and got on the next flight to Chicago.

At the time of our meeting, thousands of investors were downtown for the industrial sector’s Baird Industrial Conference – only 25 miles away – missing what we believed to be the main attraction! (As serial entrepreneur and PayPal co-founder Peter Thiel famously said, “the most contrarian thing of all is not to oppose the crowd, but to think for yourself.”)

Digging a little deeper into AAR

AAR Corp is an independent provider of aviation services to commercial and government customers worldwide.

The company purchases, sells, and leases new and used commercial jet aircrafts. It also leases a variety of new, overhauled, and repaired engines and engine products for the aviation aftermarket.

Operations are categorised across three core segments:

- Parts Supply

- Repair & Engineering; and

- Integrated Solutions

(Expeditionary Services is a largely immaterial legacy segment).

Business Segment Overview

Source: AAR Corp

AAR differentiates itself from its larger OEM competitors, by offering independent aftermarket solutions. This enables airlines, MRO’s, and military operators to reduce costs and improve supply chain efficiency.

What we’re most excited about

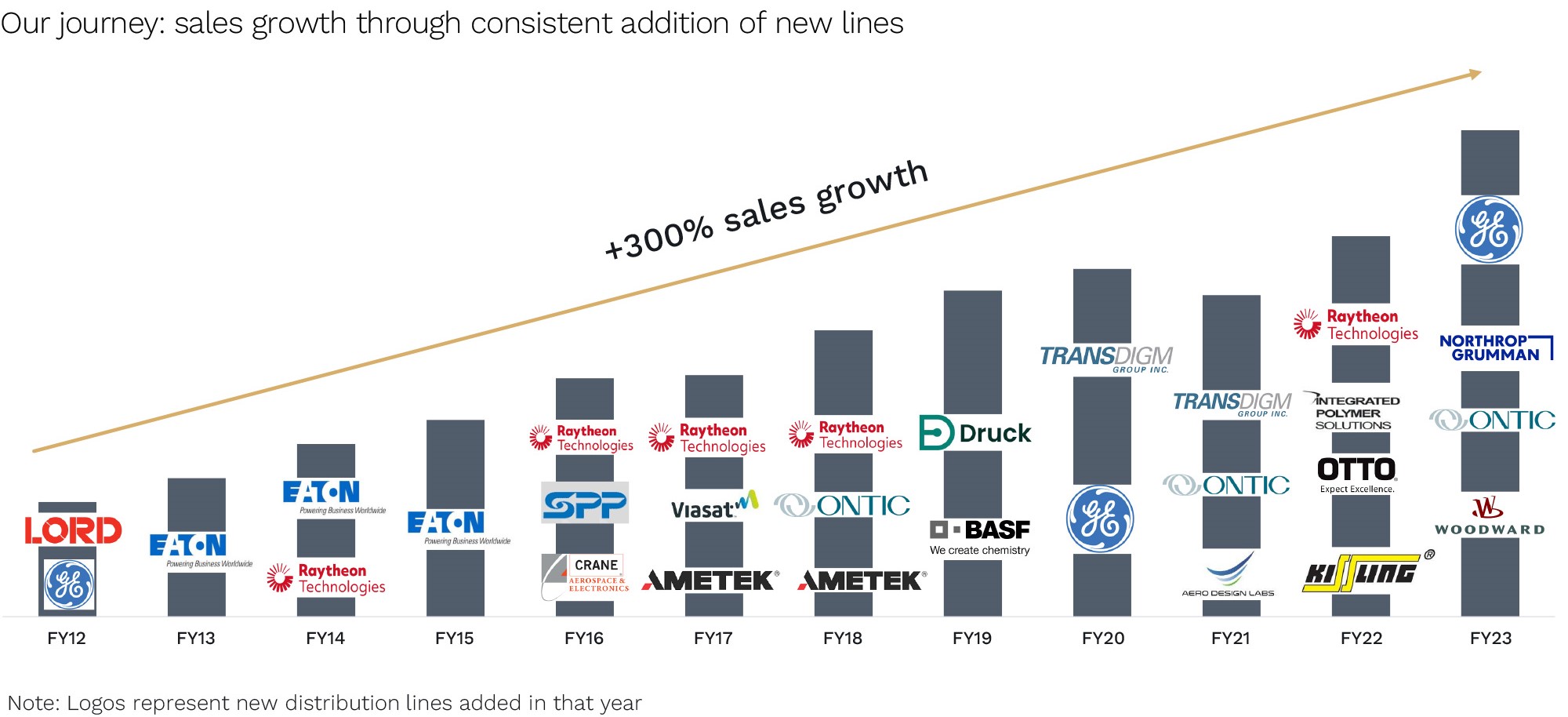

The secular tailwinds supporting growth in both parts supply and MRO activities is attractive. However, we are most excited about the potential for AAR to double market share in parts distribution.

AAR is the largest independent supplier/distributor of factory new parts, with approximately 10% market share. AAR look to partner with OEM suppliers on an exclusive basis to sell their product into the aftermarket (the market for replacement parts and accessories) – that is, they effectively act as a sales force extension for OEM suppliers, allowing the OEM suppliers to leverage AAR’s global sales network and relationships.

Satair (Airbus subsidiary) and Aviall (Boeing subsidiary) are the two largest competitors in this market with an estimated combined market share of 40-50%.

However, OEM suppliers and airline/MRO customers are increasingly partnering with independents like AAR because they offer greater pricing flexibility, better aftermarket reach, and faster inventory turnover.

Our recent channel checks suggest this dynamic is still in its infancy.

Over the next 3-5 years, we believe AAR can more than double their market share, significantly outgrowing the aftermarket industry.

Parts Supply: Distribution

Source: AAR Corp

Used Serviceable Market recovery provides a nice hedge

The USM division focuses on sourcing, repairing, and reselling used aircraft components, primarily engine materials. Instead of purchasing directly from OEM’s, AAR procures parts from lessors, airlines, and MRO’s, often from retired or surplus aircraft.

These parts are then inspected, repaired, and recertified before being resold into the aftermarket, providing a cost-effective alternative to new OEM parts.

This model is particularly attractive due to strong demand for engine materials amid supply constraints from OEM’s, making USM a high-margin and growing segment of AAR’s business.

Given the supply chain issues noted above, USM has been subdued primarily due to lower-than-expected aircraft retirements, which limits the supply of used parts.

If new aircraft deliveries accelerate and airlines phase out older fleets, we expect the USM business to recover, which often comes at higher margins. This provides a natural hedge to the business should we see any slowdown in aftermarket/MRO activity.

A win-win scenario

Having mapped out the whole ecosystem, we believe AAR offers the best return profile across the widest variety of industry outcomes.

Its USM business will benefit if aircraft production rates normalise and more planes are retired and stripped for their parts. But AAR will gain share in parts distribution.

Most other companies only win if one outcome is true.

Source: Ophir, Bloomberg.

As seen in the chart above, AAR has been delivering sound earnings growth with a largely unchanged multiple since September 2021.

We expect top-line growth combined with operating leverage to drive ~20%+ EPS CAGR over the next three years.

This will aid in deleveraging the balance sheet from the current 3.2x net debt to EBITDA level with management targeting 2.0x “two years after the recent Triumph acquisition”.

This will likely drive a multiple re-rating, with AAR currently trading on ~14x our next twelve-month EPS versus the closest peers VSEC on ~24x.

So next time your flight is delayed, it’s probably because the aging plane needs a new part, and AAR could be the one to provide it.

Learn more about the Ophir Global Opportunities Fund and Ophir Global High Conviction Fund today.