Why we Trust this Pilot to take off

November didn’t disappoint share market investors. A Trump-led rally shot the S&P500 (U.S. large caps) up +5.7% and the Russell 2000 (U.S. small caps) up +10.8% — the best monthly return for each index this year.

That was nothing compared to Bitcoin, which exploded +38.5%. Trump is seen as a ‘BFF’ (Best Friend Forever) to the crypto market.

Aussie large-caps followed the U.S. up, adding +3.2%, though Aussie small caps lagged somewhat, rising +1.3%.

The big monthly return in U.S. small caps captured the headlines though, as the market has started to price in the potential benefits of Trump’s proposed tax cuts, as well as his more protectionist policy agenda. Both should disproportionately benefit smaller and more domestically orientated U.S. businesses.

We have been delighted at the recent surge in small-caps and in this month’s Letter to Investors we lift the lid to see just what’s driving the recovery. So far, it’s largely been a story of improving valuations. But could an earnings recovery kick in and help propel small-cap share prices even higher?

We also take a close look at Trustpilot, a stock that is bringing credibility and trust to internet reviews. We watched the company for some time before buying in October this year. As you’ll see, the company and its share price have huge upside potential and it’s a stock we’re particularly excited about.

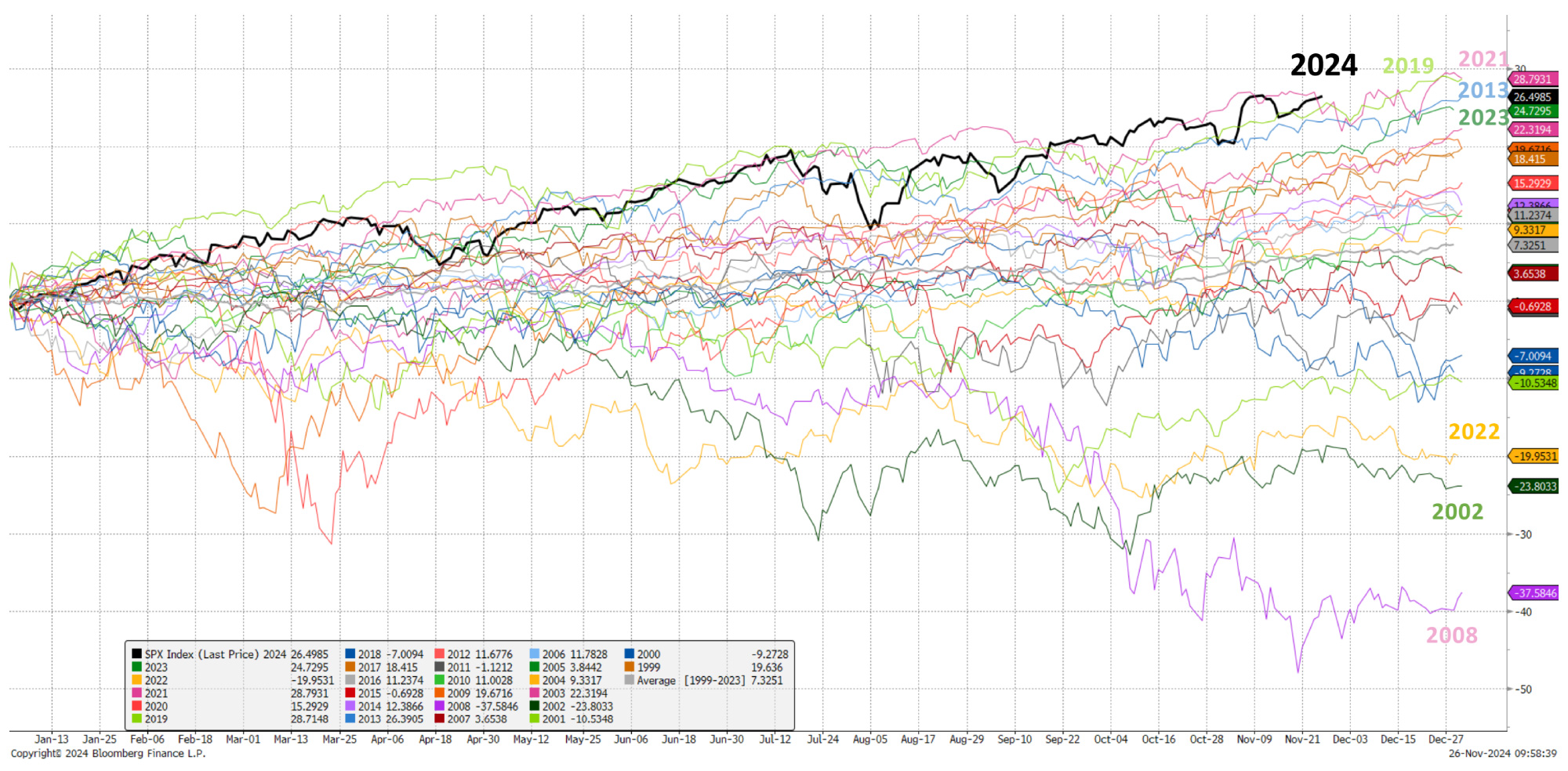

U.S. large cap Santa rally is set to continue

It’s been a banner year so far for the heavyweight U.S. share market with returns year-to-date the strongest in at least 25 years.

Source: Piper Sandler. Data to 26 November 2024.

About 17% of the 27% rise in the S&P500 this year to the end of November – or in other words a little more than half – has been expanding valuations (price to earnings ratio) as macro risks have been priced out.

The market has more comfort that U.S. inflation is under control, no recession is imminent, and election uncertainty has now been resolved.

Seasonally, we are also in the best two-month stretch for the U.S. share market (November and December), and there seems to be little that could get in the way of the Santa rally into year end.

Historically, PE re-rating is usually the precursor to a market rally as the market is forward looking despite declining or anaemic profit growth. So, the question on everyone’s mind is – will history repeat as it has done many times before?

November 2024 Ophir Fund Performance

Before diving into this month’s Letter, we’ve provided a detailed monthly update for each of the Ophir Funds below.

The Ophir Opportunities Fund returned +4.2% net of fees in November, outperforming its benchmark which returned +1.3%, and has delivered investors +23.1% p.a. post fees since inception (August 2012).

🡣 Ophir Opportunities Fund Factsheet

The Ophir High Conviction Fund (ASX:OPH) investment portfolio returned +7.5% net of fees in November, outperforming its benchmark which returned +3.5%, and has delivered investors +14.3% p.a. post fees since inception (August 2015). ASX:OPH provided a total return of +9.6% for the month.

🡣 Ophir High Conviction Fund Factsheet

The Ophir Global Opportunities Fund returned +11.9% net of fees in November, outperforming its benchmark which returned +6.8%, and has delivered investors +17.8% p.a. post fees since inception (October 2018).

🡣 Ophir Global Opportunities Fund Factsheet

The Ophir Global High Conviction Fund (Class A) returned +12.6% net of fees in November, outperforming its benchmark which returned +6.8%, and has delivered investors +13.7% p.a. post fees since inception (September 2020).

🡣 Ophir Global High Conviction (Class A) Fund Factsheet

The Ophir Global High Conviction Fund (Class B) returned +11.5% net of fees in November, outperforming its benchmark which returned +6.8%, and has delivered investors +29.1% p.a. post fees since inception (June 2023).

🡣 Ophir Global High Conviction (Class B) Fund Factsheet

A ray of light in small-cap earnings?

While U.S. large caps have seen earnings rise 10% this year (+17% valuation increase = the 27% S&P500 return), it’s been tougher in U.S. small-cap land where earnings (earnings per share or EPS in the chart below) have gone slightly backwards. Small businesses there have been suffering through more recession-like conditions.

The +16% return in the S&P600 index this year (another U.S. small cap index along with the Russell 2000) has been all driven by expanding valuations that still remain very cheap at around 19x forward earnings versus U.S. large caps at around 26x forward earnings.

Valuation increase drives all the return for U.S. small caps this year

Source: Piper Sandler at as 26 November 2024.

Valuation increases, though, are not a sustainable way to generate investment returns and do have an upper limit. Ultimately, earnings per share (EPS) growth is needed to drive the market higher over the long term.

As seen in the chart above, declines in annual earnings for U.S. small caps (S&P600) have been relatively rare. Yet it looks like both 2023 and 2024 will see U.S. small-cap earnings decline in aggregate.

The last time a decline occurred two years in a row was during the GFC in 2008 and 2009, though earnings fell much more back then, before surging strongly in 2010.

This gives some more hope that we may be nearing the end of the lengthy earnings falls or stagnation for U.S. small caps we have seen recently.

Our Funds’ portfolio companies are generating superior earnings growth

Certainly, the share market appears willing to give the new Trump administration – combined with the dialling back in monetary policy restriction from the U.S. Fed – the benefit of the doubt at present that better times are ahead for small-cap earnings.

We maintain a keen eye on small-cap earnings revisions and a handful of other key leading indicators for small-caps’ earnings to see if this is playing out.

Anecdotally, we are seeing an increasing number of our portfolio companies in the U.S. appearing more confident in their end markets given the current political and monetary policy setup. We’ll be watching closely whether this translates into increases in company guidance at their fourth-quarter results due in late January and throughout February early next year.

If it transpires, we will likely become even more positive on cyclically orientated businesses, and those that are leveraged more to the economic cycle.

Regardless, given the huge opportunity set at our disposal in our Global Funds at Ophir, and despite the slower broader backdrop for U.S. small-cap earnings this year, we still have not had trouble keeping average earnings growth in these Funds from our portfolio companies in the +20-25% range.

Trustpilot: Good things come to those who wait

“Trust is like the air we breathe – when it’s present, nobody really notices; when it’s absent, everybody notices.” Warren Buffett

Trustpilot (LON: TRST) is a London-listed, Danish-founded consumer business operating a review website, which hosts reviews of businesses worldwide. Around 1 million new reviews are posted each month.

Reviews are written by any consumer with a Trustpilot account who has had a recent buying or service experience, as long as they follow the Guidelines for Reviewers, and don’t have a conflict of interest with the business they’re reviewing.

Consumers who’ve had an experience with a business can create a Trustpilot account and write an unsolicited review (“organic reviews”). Businesses can also ask their customers to leave a review by invitation. There should be no bias in the way customers are invited to review, with no offer of payment or incentive.

What sets Trustpilot apart is their commitment to transparency and neutrality. They ensure the platform is a trusted space where customers feel heard, and businesses can demonstrate their integrity.

A commissioned study conducted by Forrester Consulting on behalf of Trustpilot found that organisations deploying Trustpilot achieved a remarkable 401% return on investment over three years. These organisations experienced significant benefits, including improved customer acquisition and operational efficiencies.

Additionally, Trustpilot helped increase web traffic by 25% in the first year, 30% in the second, and 35% by the third year. These metrics underscore Trustpilot’s pivotal role in enhancing business performance through trust and transparency.

Trustpilot’s business model has strong network effects. As more consumers use Trustpilot to review more businesses, more domains and businesses are added to the platform. More businesses claim their profiles, and over time become customers.

As the flywheel keeps spinning – this drives organic growth, strengthens the brand and market position, while simultaneously and creating high barriers to entry.

Trust follows the adage of “goes up the escalator and down the elevator” demonstrating barriers/ time to build adequate consumer reviews yet easy loss of confidence in website if reviews aren’t honest. If the business can overcome this dynamic, then it should build adequate moat to monetise model as difficult for competitors to replicate.

Lofty initial expectations came back towards earth

We first met Trustpilot management during the 2021 IPO process. Despite evidence of good early momentum across the business, we passed on valuation grounds. At the 265p IPO price we were being asked to pay too much for potential success in the U.S. where there was limited penetration at the time.

Patience pays off

Source: Ophir, Bloomberg. Data to 30 November 2024.

This was a good decision because Trustpilot’s share price declined materially after peaking towards the end of 2021 and tracked broadly sideways from mid-2022 and much of 2023 due to macro factors.

Stock-specific factors also impacted the share price. The initial roll-out in the U.S. was ‘scatter-gun’ and lacked focus. That was a key element holding us back from buying the stock.

Yet because of its unique business model and significant market opportunity, we continued to follow the company.

But during 2023 we noticed Trustpilot’s approach to the U.S. became much more focused. The company homed in on a few core verticals (e.g. financial services, education).

This improved growth and more specifically net revenue retention (another way to describe customer retention). That was the evidence we needed to see before re-engaging with the company.

So in early 2024, we met with management in their U.S. headquarters in Denver. We were impressed with the ongoing execution in the UK, as well as the momentum that was building in other jurisdictions globally, including the U.S.

We subsequently caught up with the company on a handful of occasions over the next few months, after which we invested in the company. Our patience and valuation discipline allowed us to see the company execute for several years and, ultimately, we initiated our position below the IPO price.

We see big upside for the company and its share price for several reasons:

- The UK and other markets remain underpenetrated

The UK is Trustpilot’s most penetrated region. However, with 1H24 bookings of US$47m in a serviceable addressable market (SAM) of ~US$1.7 billion this equates to only ~5% penetration.

Source: Ophir. Company Financials.

This provides a meaningful growth runway; while also providing a reasonable blueprint for what the terminal/mature economics of the business may look like for the group.

- Trustpilot continues to show strong network effects

Since 2018 UK bookings have grown at a ~20% compound annual growth rate (CAGR), while sales and marketing dollars have remained broadly stable, based off our internal estimates for the UK division. This demonstrates the strong network effects when consumer awareness hits a tipping point.

Source: Ophir. Company Financials.

- The company is still seriously undervalued

Our comparative analysis shows that businesses with a similar growth and margin profile to Trustpilot’s UK business trade on 8-9x annual recurring revenue (ARR).

This results in a UK valuation of ~US$1 billon and implies we are paying ~US$500 million (or 3x ARR) for Europe & the Rest of the World (RoW) and North America, which combined are 10x the SAM of the UK.

- Data shows strong momentum globally

We think near-term momentum will show acceleration in the U.S. and EU/Row based off our data tracking, calls with regional experts and tracking of onboarded and paying companies.

For key markets and verticals, we closely monitor Google search visibility, the quality and volumes of reviews as well as engagement and conversion. We also track corporates who are signed up and paying them.

Our data tracking shows Trustpilot’s robust performance in established markets such as the UK. It also demonstrates the critical U.S. market is accelerating alongside Germany, France and Italy, which are core to the Europe/RoW segment.

Source: Ophir, Google Trends.

- Trustpilot’s U.S. position continues to strengthen

When compared to competitors in the U.S., such as Stamped, Yotpo, Bazaarvoice and Birdeye, Trustpilot has demonstrated more consistent performance and a positive trajectory. This suggests a strengthening of its position in the U.S. market. The strong interest levels against a backdrop of competitor volatility suggests Trustpilot is on the path to becoming the pre-eminent platform in the trust and review ecosystem.

Source: Ophir, Google Trends.

A significant runway for growth

Given their large markets, significant upside to penetration, high long-term margins and limited competition due to high barriers to entry, as well as strong network effects, we see significant upside for Trustpilot.

As management continues to execute, the market will get more comfortable with the long-term growth opportunity in North America, Europe and the Rest of the World.

This is a great example of how being patient and waiting for a better entry point can pay off. By applying our GARP (growth at a reasonable price) investment philosophy at the time of the IPO, we were effectively given a free look at how the business executed for the following 3 years.

As always, thank you for entrusting your capital with us.

Kindest regards,

Andrew Mitchell & Steven Ng

Co-Founders & Senior Portfolio Managers

Ophir Asset Management

This document is issued by Ophir Asset Management Pty Ltd (ABN 88 156 146 717, AFSL 420 082) (Ophir) in relation to the Ophir Opportunities Fund, the Ophir High Conviction Fund and the Ophir Global Opportunities Fund (the Funds). Ophir is the trustee and investment manager for the Ophir Opportunities Fund. The Trust Company (RE Services) Limited ABN 45 003 278 831 AFSL 235150 (Perpetual) is the responsible entity of, and Ophir is the investment manager for, the Ophir Global Opportunities Fund and the Ophir High Conviction Fund. Ophir is authorised to provide financial services to wholesale clients only (as defined under s761G or s761GA of the Corporations Act 2001 (Cth)). This information is intended only for wholesale clients and must not be forwarded or otherwise made available to anyone who is not a wholesale client. Only investors who are wholesale clients may invest in the Ophir Opportunities Fund. The information provided in this document is general information only and does not constitute investment or other advice. The information is not intended to provide financial product advice to any person. No aspect of this information takes into account the objectives, financial situation or needs of any person. Before making an investment decision, you should read the offer document and (if appropriate) seek professional advice to determine whether the investment is suitable for you. The content of this document does not constitute an offer or solicitation to subscribe for units in the Funds. Ophir makes no representations or warranties, express or implied, as to the accuracy or completeness of the information it provides, or that it should be relied upon and to the maximum extent permitted by law, neither Ophir nor its directors, employees or agents accept any liability for any inaccurate, incomplete or omitted information of any kind or any losses caused by using this information. This information is current as at the date specified and is subject to change. An investment may achieve a lower than expected return and investors risk losing some or all of their principal investment. Ophir does not guarantee repayment of capital or any particular rate of return from the Funds. Past performance is no indication of future performance. Any investment decision in connection with the Funds should only be made based on the information contained in the relevant Information Memorandum or Product Disclosure Statement.